RECORDING OR RELEASING A LIEN

What Is a Lienholder?

A lienholder is the person or organization that has a legal interest in a vehicle until a loan or financial obligation is paid in full.

In simpler terms, it’s the lender or person who financed the vehicle and holds a claim to it until the debt is cleared.

A lienholder can be any of the following:

-

An individual

-

A business or dealership

-

A bank, credit union, or financial institution

-

A trust

The lienholder cannot be the same person or organization listed as the registered owner on the title.

Recording a Lien

Alaska law allows the recording of a primary lienholder on a vehicle title.

Secondary lienholders may record their liens through a Uniform Commercial Code (UCC) filing at a local district recorder’s office. A secondary or subsequent lienholder may be recorded for a manufactured home, however only the primary lienholder will be listed on the title.

To record a lien, you must submit:

-

Application for Title & Registration (Form V1) – completed in full, signed, and dated. The lienholder’s name and mailing address must be listed.

-

Original title or Manufacturer’s Certificate of Origin (MCO)

-

Fees:

-

$15 lien recording fee

-

$15 title fee

-

$100 title fee for manufactured homes

-

-

-

Any additional fees or registration documents, if applicable

The registered owner must sign the application before it will be accepted.

A Power of Attorney (Form 847) is acceptable if someone other than the registered owner is signing on their behalf for any of the included documents.

Once the lien is recorded, the new title will automatically be mailed to the lienholder. If your lienholder requires expedited delivery you may include a pre-paid envelope to the same mailing address as listed on the application for the lienholder.

Releasing a Lien

When you make the final payment on your vehicle, the lienholder will release their interest in the vehicle and provide the original title to you.

Once you receive the title, you must apply for a clear title through the DMV.

To obtain a clear title, submit:

-

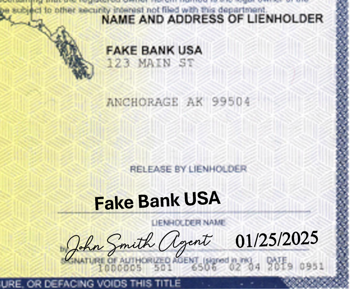

Original title showing the lien release, either:

-

Signed by the lienholder on the front of the title

-

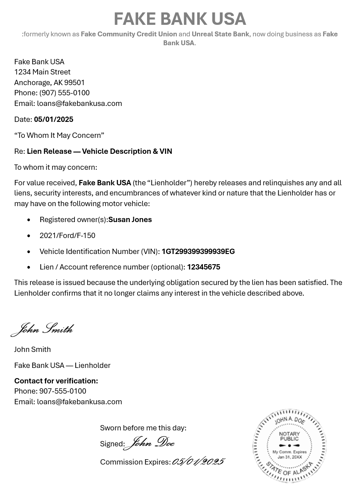

Accompanied by a notarized lien release letter from the lienholder

-

-

The release must include the date, signature, and title of the person releasing the lien.

-

-

-

A “PAID” stamp alone is not acceptable.

-

-

-

$15 title fee

If your title has been lost, you must obtain a lien release from the financial institution before applying for a duplicate or clear title.

- Application for Duplicate Title (Form 809)

- Completed, signed and notarized by the owner or lienholder

-

Accompanied by a notarized lien release letter from the lienholder

-

The release must be on letterhead from the lienholder

- Vehicle description including the Vehicle Identification Number (VIN)

- The release must include the date, signature, and title of the person releasing the lien.

- Note: If the name of the organization has changed since the lien was first recorded (common among financial institutions) then a statement must be included in the letter listing that the releasing organization is one and the same as the one listed on the title.

-